Report: Sport rights, ad tiers reshaping VoD market

February 13, 2025

Kantar, the marketing data and analytics company, reveals a growing consumer preference for ad-supported streaming, robust momentum for Apple TV+, increasing investment in sports content and Netflix’s continued strength in delivering engaging entertainment in its Q4 Entertainment on Demand (EoD) data on the global streaming market. The study, from Kantar’s Worldpanel division, uncovered the following behaviours between October and December 2024:

- Black Doves was the most enjoyed show, followed by The Day of the Jackal, Lord of the Rings: The Rings of Power, Yellowstone and Outer Banks

- Apple TV+ and Paramount+ were the fastest growing major VoD streamers year-on-year

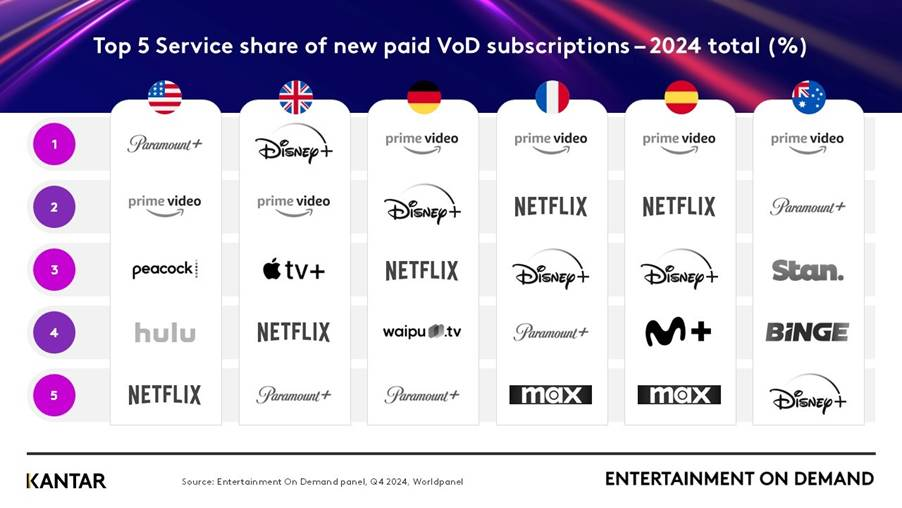

- Prime Video achieved the highest share of new paying subscribers, with Paramount+ second and Netflix third

- Paid ad-supported subscribers rose by 3 per cent quarter-on-quarter

- Nearly two in five (38 per cent) of new VoD users opted for premium subscription models

- Paid ad-supported captured 35 per cent, FAST accounted for 20 per cent and virtual multichannel video programming distributor (vMVPD) services that offer TV over the internet claimed 7 per cent of the global market

- Two in three (66 per cent) new Netflix subscribers chose the ad-supported tier

Netflix raises the bar with WWE and NFL

Netflix began 2024 with two major announcements: the removal of its cheapest ad-free plan and an expansion into live sports streaming with the acquisition of WWE starting in 2025. However, as Ted Sarandos emphasised, the focus remains on the entertainment value of sports – a strategy reinforced by Netflix’s highly anticipated NFL Christmas Day games. Sports alone drove 18 per cent of new Netflix subscriptions globally in Q4 2024, helping Netflix to rank third among new paying subscribers globally, recording subscriber growth in nearly every country tracked by Kantar except Australia. Subscriber satisfaction has rebounded to previous highs, reflected in its highest Net Promoter Score (NPS) of +44 since Q1 2022 and underscoring its role in setting the industry standard.

NFL drives growth and starts to unlock international audiences

The progression of sports streaming continues to reshape the media landscape. Following its acquisition of NFL’s Sunday matches for the 2023/2024 season, YouTube TV experienced an impressive 48 per cent surge in subscribers from Q3 2023 to Q4 2024 – a testament to the increasing demand for premium sports content. This performance highlights the value of YouTube TV’s strategic partnership with the NFL to engage new, broader audiences.

American football emerged as the fastest-growing sport in viewership, which now captivates 42 per cent of households watching sport in Q4 2024, up 6 percentage points from the previous quarter. Successful NFL international games in Germany and London, alongside upcoming fixtures in Dublin (2025) and Melbourne (2026), highlight a growing global appeal as media giants compete over untapped international sport audiences.

Meanwhile, Disney pivoted strategically under CEO Bob Iger by merging its Hulu + Live TV business with Fubo following the collapse of Venu Sports. This is in addition to the anticipated direct-to-consumer ESPN launch expected later this year. By integrating ESPN into broader bundle deals to maximise reach, and leveraging curated, sports-focused packages that drive engagement and retention, Disney is strengthening its hold on the media landscape.

In this competitive arena, delivering accessibility, affordability, and a premium viewing experience is paramount. This is evidenced by Comcast Xfinity’s new targeted strategy with its recent launch of a ‘skinny’ bundle offering exclusively live sports and news content. This is designed to appeal to consumers who want a curated output – especially relevant given that 63 per cent of its customers were tuned into sports in Q4 last year.

Andrew Skerratt, Global Insight Director at Kantar’s Worldpanel, commented: “The NFL is rewriting the playbook for streaming. A 48 per cent surge in subscribers isn’t just a number – it’s a stark reminder that fans worldwide are hungry for real-time, premium sports experiences.”

35% of new subscribers embrace paid ad-supported streaming

Ad-supported streaming delivered significant momentum in Q4 2024, with 35 per cent of new VoD subscribers opting for paid ad-supported models – a substantial increase from 21 per cent the year before. Following initial resistance, these tiers are now showing stronger retention rates, driven by the perceived value for money. In fact, 43 per centof ad-tier users report satisfaction with the value they receive – a rate that exceeds that of ad-free subscription tiers – while only 23 per cent of VoD households oppose seeing ads. As streaming platforms refine their ad strategies, the challenge will be to maintain premium content quality alongside a seamless, engaging ad experience.

Apple TV+ impressive content and bundles drive global appeal

Since its debut in late 2019, Apple TV+ has experienced steady growth but 2024 proved to be a breakout year. Now, 28 per cent of subscribers globally identify Apple TV+ as their primary VoD platform, up 3 percentage points year-on-year. Enhanced content quality, compelling local and international programming, attractive bundled offers, and strategic promotions all contributed to overall consumer satisfaction. Apple TV+ also ranked fourth in attracting new paying subscribers, with 49 per cent of new sign-ups citing bundling and promotional activity as key motivators. This winning mix has driven an impressive 14 per cent year-over-year subscriber growth, including a remarkable 21 per cent increase in Germany.

Skerratt concluded: “Our Q4 2024 data unveils a significant shift in the global streaming landscape. Bold, innovative ad-supported models, live sports integrations, and an unyielding commitment to premium content are rewriting the rulebook on consumer behaviour. Giants like Prime Video, Netflix and Apple TV+ are not just in the game – they’re redefining it by capturing fresh audiences and igniting relentless engagement in a fiercely competitive arena. The future of streaming isn’t a distant dream – it’s a dynamic revolution, balancing stellar content with unparalleled viewing flexibility, and it’s already in full swing.”

Other posts by :

- Russian satellite tumbling out of control

- FCC boss praises AST SpaceMobile

- Rakuten makes historic satellite video call

- Rocket Lab confirms D2C ambitions

- Turkey establishes satellite production ecosystem

- Italy joins Germany in IRIS2 alternate thoughts

- Kazakhstan to create museum at Yuri Gagarin launch site

- AST SpaceMobile gets $42 or $1500 price target

- Analyst: GEO bloodbath taking place