Forecast: TikTok ad revenue to top $32bn in 2025

March 5, 2025

TikTok, the ByteDance-owned video sharing platform, is increasingly seen as able to drive full-funnel outcomes – from discovery through search to purchase. However, WARC Media reports that concern over TikTok’s possible ban in the US is creating uncertainty among advertisers and creators.

Alex Brownsell, Head of Content, WARC Media, and author of the report, says: “On 18 January, US TikTok users were unable to access the video-sharing app for more than 12 hours due to regulation banning the app on the basis of national security concerns. A 75-day deadline extension to 5 April by President Donald Trump does little to dispel the uncertainty around TikTok as an ongoing staple in many brands’ marketing plans. In this report, we explore the potential impact of a US ban on TikTok’s advertising revenue, and examine the platform’s role in consumer behaviour and campaign effectiveness.”

Providing evidence-based insights on the challenges and opportunities TikTok has to offer, WARC Media’s Platform Insights report offers an overview of the key data points that advertisers need to know about the platform spanning investment, consumption and performance.

Investment: Global TikTok ad revenue forecast to reach $32.4bn.

In 2025, assuming a US ban is not implemented, ad spend with TikTok should reach $32.4 billion, a rise of 24.5 per cent year-on-year. TikTok’s ad business is set to grow faster than either Facebook (+9.3 per cent) and Instagram (+19 per cent) this year, giving the video-sharing app an 11 per cent share of the global social media market.

According to WARC’s Marketer’s Toolkit survey carried out late in 2024, global marketers were more likely to increase investment with TikTok in 2025 than with any other digital platform. Agency respondents (81 per cent) were even more bullish than their client counterparts (74 per cent).

The US remains TikTok’s largest market, but over the last five years its share of the platform’s total ad revenue has diminished, dropping from 43.3 per cent in 2022 to 34 per cent by 2026, according to WARC Media forecast. Ad revenue is growing faster outside of the US, potentially mitigating the impact of any ban in the US.

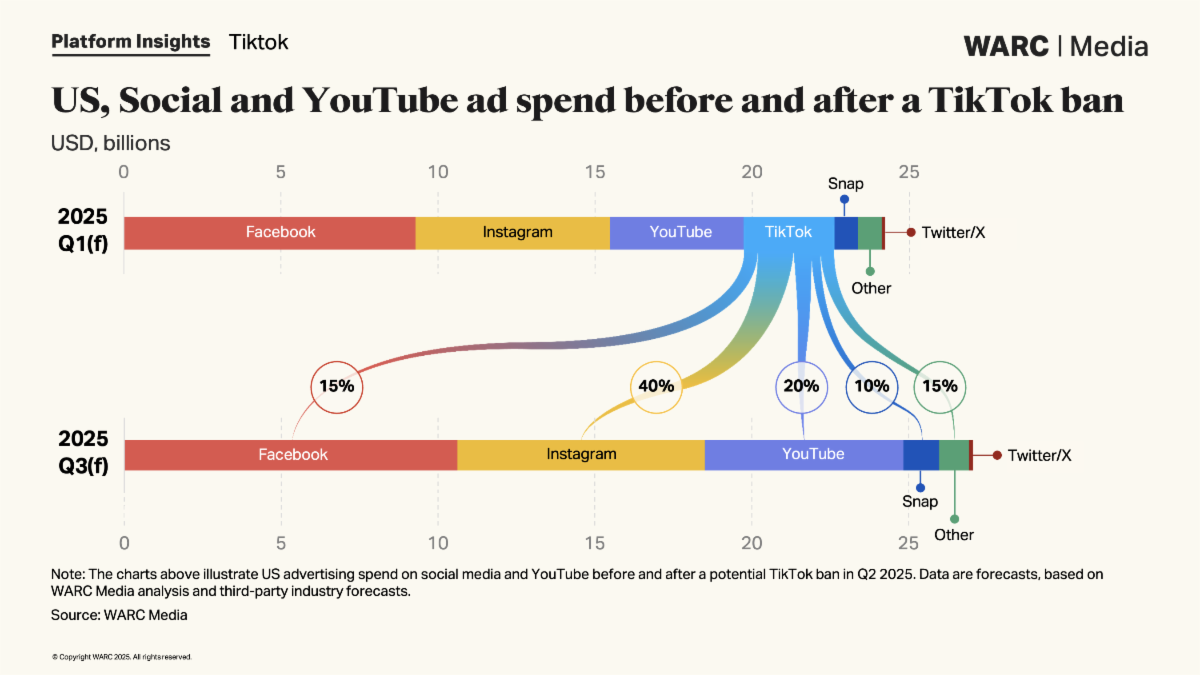

If a ban in the US is avoided, TikTok is forecast to earn $11.8 billion in US ad revenue this year (up 21 per cent, outpacing overall US social media ad investment, which is set to grow 10.6 per cent), rising to $13.4bn in 2026. Instagram stands to benefit most from a TikTok ban, WARC Media estimates, with spend also going to YouTube and Snapchat.

Consumption: Globally, TikTok users spend 35 hours with the app each month

TikTok’s ad reach is currently reported to be 1.59 billion. It is the fifth most-used mobile app globally, and the second most popular app for women aged 16-24. The US remains TikTok’s largest market, with 136 millio active adult accounts, equivalent to two in five Americans.

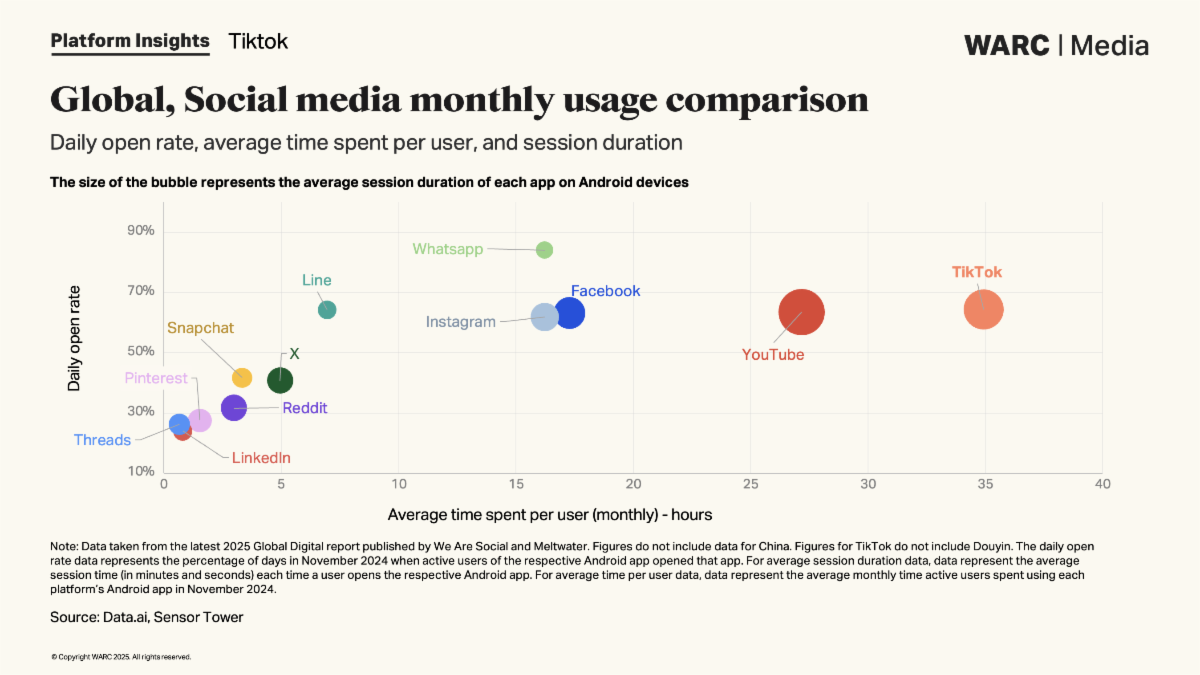

Total monthly usage on TikTok by far exceeds that of any other platform, with the average user spending more than 35 hours on the app each month in 2024 – more than double the average usage by Instagram users. Consumption levels are even greater in the US, with users spending an average of almost 44 hours per month on TikTok or almost one and a half hours per day.

Established platforms with short-form video features like Instagram’s Reels and YouTube’s Shorts are likely to win more traction from any ban in the US and friction in Canada.

More than half (57 per cent) of global TikTok users utilise the platform’s search function to follow or find information about products and brands, according to We Are Social. Advertisers so far are ‘intrigued’ but cautious over concerns such as effectiveness and safety.

Performance: advertising on TikTok impacts Amazon sales

Kantar’s latest Media Reactions study found that TikTok has again claimed first place, jointly with Amazon, as consumers’ most preferred advertising platform, and is viewed as the ‘most fun’ and entertaining. However, excessive targeting could be an issue, and TikTok also falls short of the industry average in terms of the trust marketers place in it compared to YouTube, Netflix and Instagram.

One of the key trends outlined by TikTok for 2025 is that creative quality and variety can positively drive performance. To assist, TikTok has built various AI-powered tools such as TikTok Symphony and TikTok One.

Data shows that specific branded content in collaboration with creators drive higher view-through rates, engagement and ad recall.

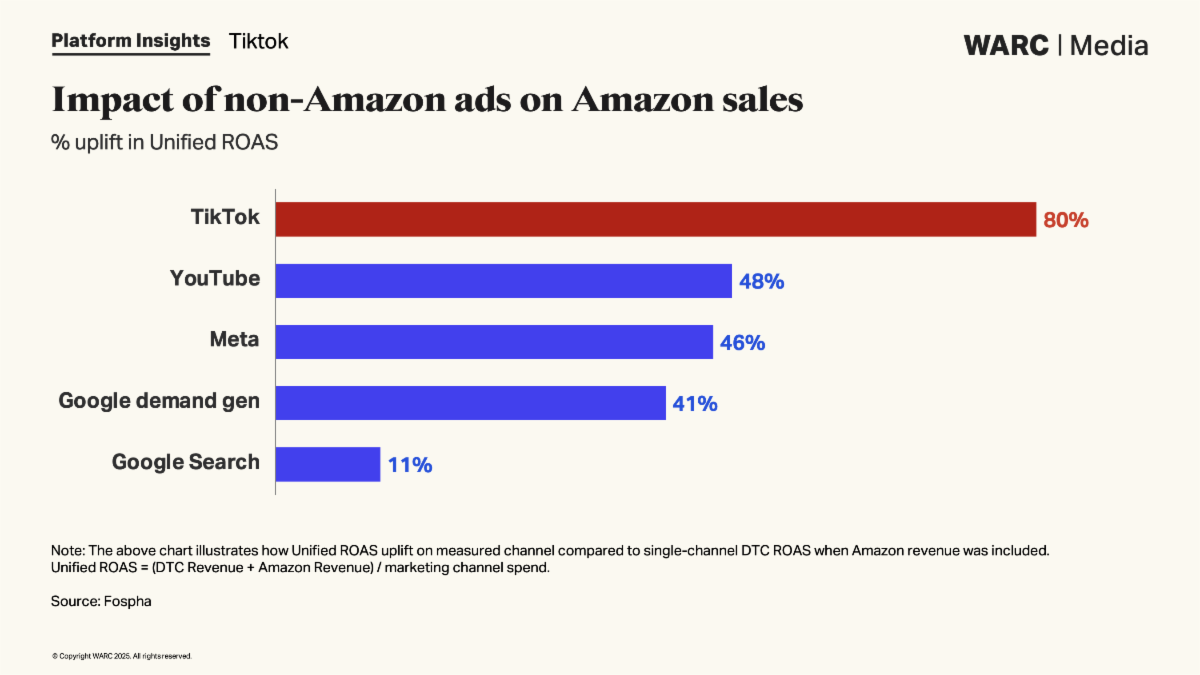

Investment in upper-funnel campaigns on platforms like TikTok, Meta and YouTube can significantly influence Amazon sales, a study by Fospha has found. On average, TikTok’s direct-to-consumer only return on ad spend (ROAS) was 2.4x; however, when amazon revenue was factored in, Unified-ROAS, as coined in the study, increased to 4.2x, showing that TikTok is having a previously unseen impact on Amazon sales.

Other posts by :

- Russian satellite tumbling out of control

- FCC boss praises AST SpaceMobile

- Rakuten makes historic satellite video call

- Rocket Lab confirms D2C ambitions

- Turkey establishes satellite production ecosystem

- Italy joins Germany in IRIS2 alternate thoughts

- Kazakhstan to create museum at Yuri Gagarin launch site

- AST SpaceMobile gets $42 or $1500 price target

- Analyst: GEO bloodbath taking place