Report: Europe severely lags other major regions in 5G SA

February 24, 2025

Developed in collaboration with Omdia, the report, A Global Evaluation of Europe’s Digital Competitiveness in 5G SA, focuses on Europe’s competitiveness in the technology, progress in monetising the 5G core for consumer and enterprise use cases, and successful government policies, forming part of a flagship global report on 5G SA commercialisation progress.

Key takeaways from the report include:

-

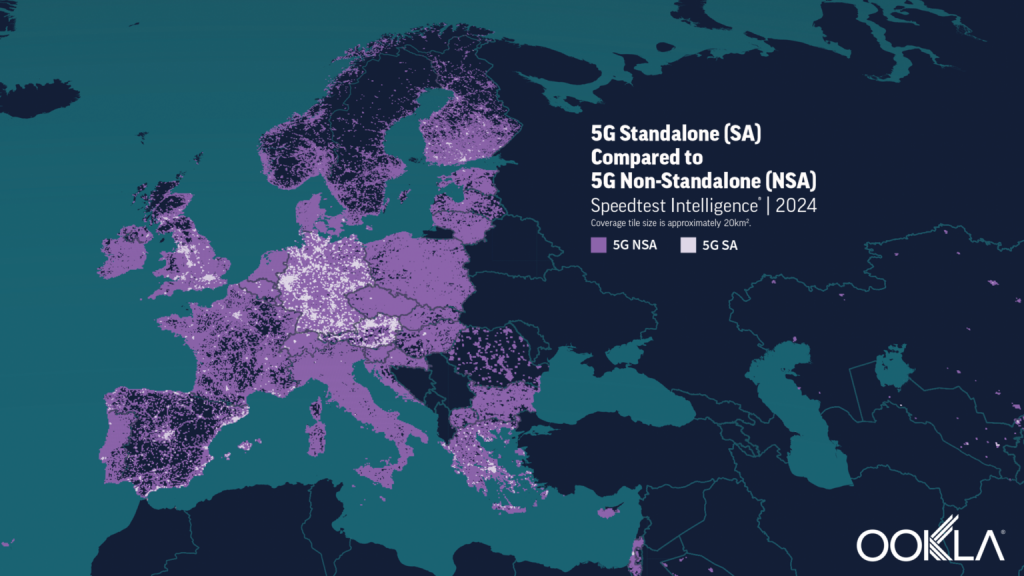

While Europe has set the most ambitious 5G infrastructure targets of any advanced liberal economy, it currently features the poorest outcomes in terms of 5G SA performance among major regions. The interplay of earlier deployments, a more diversified multi-band spectrum strategy, and greater operator willingness to invest in the 5G core to monetise new use cases have driven rollouts at a faster pace in regions outside Europe.

-

At the operator level, BT’s EE has adopted a highly diversified spectrum strategy in the UK, allocating as much as five or six spectrum carriers to its 5G SA deployments across large parts of major cities. By aggregating multiple carriers across low- and mid-band spectrum, EE has executed one of the most comprehensive 5G SA deployments in Europe.

Within Europe, while 5G SA rollout progress remains highly varied, the best outcomes have been observed in countries that have actively mobilised policies to incentivise 5G SA deployment. Germany, the UK and Spain – all four-player markets benefiting from targeted 5G SA-specific fiscal stimuli or coverage obligations – lead Europe in terms of 5G SA rollout across multiple operators.

To capture the full monetisation potential of the technology, European operators need to adapt their business models and cater to new verticals:

-

While 5G investments in Europe have yet to yield significant monetisation, operators in other regions are leveraging the enhanced performance and flexibility of the new 5G core to drive tariff and service innovation. They are focusing on consumer segmentation with performance-oriented tariff upsells and developing tailored network slices to deliver new services across diverse enterprise verticals.

-

European operators at the forefront of business model evolution with 5G SA – such as BT’s EE in the UK, Deutsche Telekom in Germany, Elisa in Finland, and Drei in Austria – are leveraging the technology to consolidate their positions at the premium end of the market and stimulate ARPU growth.

Other posts by :

- Russian satellite tumbling out of control

- FCC boss praises AST SpaceMobile

- Rakuten makes historic satellite video call

- Rocket Lab confirms D2C ambitions

- Turkey establishes satellite production ecosystem

- Italy joins Germany in IRIS2 alternate thoughts

- Kazakhstan to create museum at Yuri Gagarin launch site

- AST SpaceMobile gets $42 or $1500 price target

- Analyst: GEO bloodbath taking place